MUMBAI: The crash of an Air India Boeing 787 Dreamliner in Ahmedabad has set off what may become India’s costliest aviation insurance claim, with potential liabilities crossing Rs 1,000 crore, which is more than the total annual premium for the country’s aviation sector. While the aircraft’s age may help contain hull loss, the crash, which reportedly killed over 240 people and caused collateral damage on the ground near the airport, is expected to result in significant liability payouts.Air India has insured its fleet through a $20-billion aviation programme. Hull and liability coverage are split, with Tata AIG, a group company, underwriting part of the risk alongside other domestic insurers. The reinsurance structure is led by a global consortium including AIG, with participation from public sector entities such as New India Assurance and GIC Re. Shares of both fell following the incident by 4% and 3%, respectively.

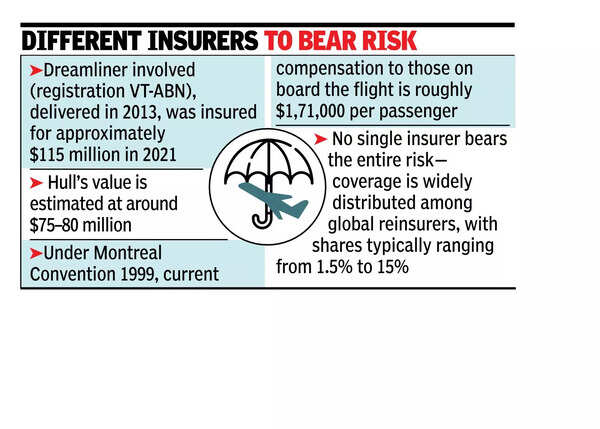

Amit Agarwal, CEO and MD at Howden India, said that aircraft damage would be covered under the aviation hull all-risk section, which insures the current valuation of the aircraft, including spares and equipment. The Dreamliner involved (registration VT-ABN), delivered in 2013, was insured for approximately $115 million in 2021. “Whether the damage is partial or total, the loss would be covered based on the value declared by the airline.“While the hull loss is substantial, liability claims are expected to be larger. “The liability section which is likely the most significant component of the loss, could amount to millions of dollars,” said Agarwal, referring to passenger deaths and potential third-party claims from the crash site. Under the Montreal Convention of 1999, compensation to passengers is calculated in Special Drawing Rights (SDRs), with a current value of 1,28,821 SDRs, or roughly $1,71,000 per passenger.Further clarity came from Hitesh Girotra of Prudent Insurance Brokers, who estimates the hull value at around $75-80 million. “The liability on the operator will have multiple angles,” he said. “The nationality of the passengers will determine the minimum liability under the Montreal Convention. “Additionally, there is third-party property damage liability, and possibly loss of civilian lives where the aircraft crashed.”The scale and complexity of the claim reflect the evolving nature of aviation insurance. Narendra Bharindwal, president of the Insurance Brokers Association of India, offered a broader context: “Insurance coverage for large commercial aircraft such as the Boeing 787 is substantial and structured globally.” He added, “Hull values can range between $200-300 million and liability cover for international routes often exceeds $500 million.“Air India’s aviation programme, like others of its size, is reinsured across global markets. No single insurer bears the entire risk.