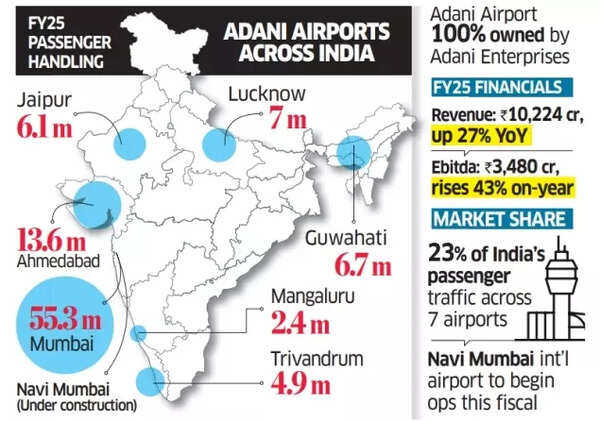

Adani Airport Holdings Ltd (AAHL) is considering raising approximately $1 billion in equity from international investors whilst assessing expansion strategies and possible acquisitions, Adani Group CFO Jugeshinder Singh has said. The airport venture will be seeking external investor equity funding for the first time.The airport division, which is entirely owned by Adani Enterprises Ltd, has an estimated value of $20 billion, according to sources quoted in an ET report. This valuation surpasses GMR Airport’s market capitalisation of $10.4 billion. GMR operates airports across various locations including New Delhi, Hyderabad, Goa and Nagpur.AAHL, which holds the position of India’s largest private airport operator, currently manages seven airports – Mumbai, Ahmedabad, Lucknow, Mangaluru, Jaipur, Guwahati and Thiruvananthapuram. The company is completing its eighth airport in Navi Mumbai, scheduled to commence operations in August.Adani Airport Holdings Seeks International Investors“Everyone wants to do airports with us – investors from the US, Middle East and Australia have evinced interest in investing in the business,” said Sagar Adani, nephew of group chairman Gautam Adani. Sagar Adani is also executive director, Adani Green Energy.CareEdge Ratings estimates that India’s air passenger traffic will grow at 9% CAGR between FY25 and FY27, reaching a volume of 485 million.

Adani Airports Across India

According to the Directorate General of Civil Aviation, India’s domestic air passenger traffic showed a 10.35% yearly increase in FY25. Airlines transported 14.54 million passengers across their routes.AAHL plans to capitalise on this growth by expanding its infrastructure, particularly with airports in Mumbai-Navi Mumbai and other strategic locations, aiming to triple its capacity over the next 15 years.Also Read | Big worry! China’s grip over rare earth magnets sends Indian auto industry into a spin; delegation of industry people eye China visitWhilst the company maintains sufficient funding at present, it remains open to securing additional capital based on timing and market circumstances.Adani CFO Singh indicated uncertainty about their immediate plans, saying, “We also have not decided whether we want to do it or not yet. So what we are thinking about is — is it a good idea for us to do it right now or should we wait two-three years once the build-out happens and the value is established.”In January, Abu Dhabi Investment Authority (ADIA) provided an investment of ₹6,300 crore to GMR Enterprises (GEPL), the promoter entity of GMR Group, to decrease their debt burden.Regarding expansion plans, Singh said, “We are open to acquisitions in India and internationally. For international deals, it will have to be an international city pair which caters to an Indian diaspora. If there’s a lot of Indian passengers going to a specific airport in some other city in the world, and if that opportunity comes up, we will look at that.”The organisation plans to establish the airport business as an independent subsidiary within the next two-three years, before proceeding with its listing.AAHL reported a 7% increase in passenger traffic, handling 94 million passengers in FY25 compared to FY24.Also Read | ‘Better than America…’: Nitin Gadkari asserts India’s roads to be comparable to US in 2 years, adds ‘main picture yet to start’